"Real Investing Experiments. Transparent Results."

Cipher Mining (CIFR): A Deep Dive Investment Analysis

The Core Investment

Cipher builds and develops industrial-scale data centers (with a bunch of GPUs) for bitcoin mining and HPC hosting. They sell this HPC to hyperscalers for uses such as AI, recently making a deal with Amazon.

Bitcoin miners pivoting to AI infrastructure generally pursue one of three models. In a colocation or powered shell model, the company builds and owns the data centers themselves, providing power, cooling and physical space, while tenants (like AWS or Fluidstack) make deals with them and bring in their own servers and equipment. Esentially being an infrastructure landlord agreement. This model usually has lower risk and more predictable cash flows but can by capped to the upside since the host doesn’t capture any compute margins. In a bare metal or GPU-as-a-service model, the company owns and operates the actual servers and GPU’s, renting out raw compute to customers. This model offers higher revenue per megawatt but requires way more capex for hardware (GPU’s) that depreciate very quickly and it usually takes more time to set up. All of Cipher’s current hyperscaler deals are colocation agreements.

Currently, the top two drivers of CIFR revenue are Bitcoin mining, accounting for $71.7 million in Q3 2025, and power sales—selling excess electricity back to the grid—making about $2.3 million. Total revenue sits at $72 million, with mining being almost all of it. They are transitioning to more HPC with long-term leases and partnerships, e.g., a 15-year deal with Amazon worth $5.5 billion and a 10-year agreement with Fluidstack/Google for $3 billion. However, these have not yet started to generate revenue and are expected to begin in 2026.

The Power Advantage

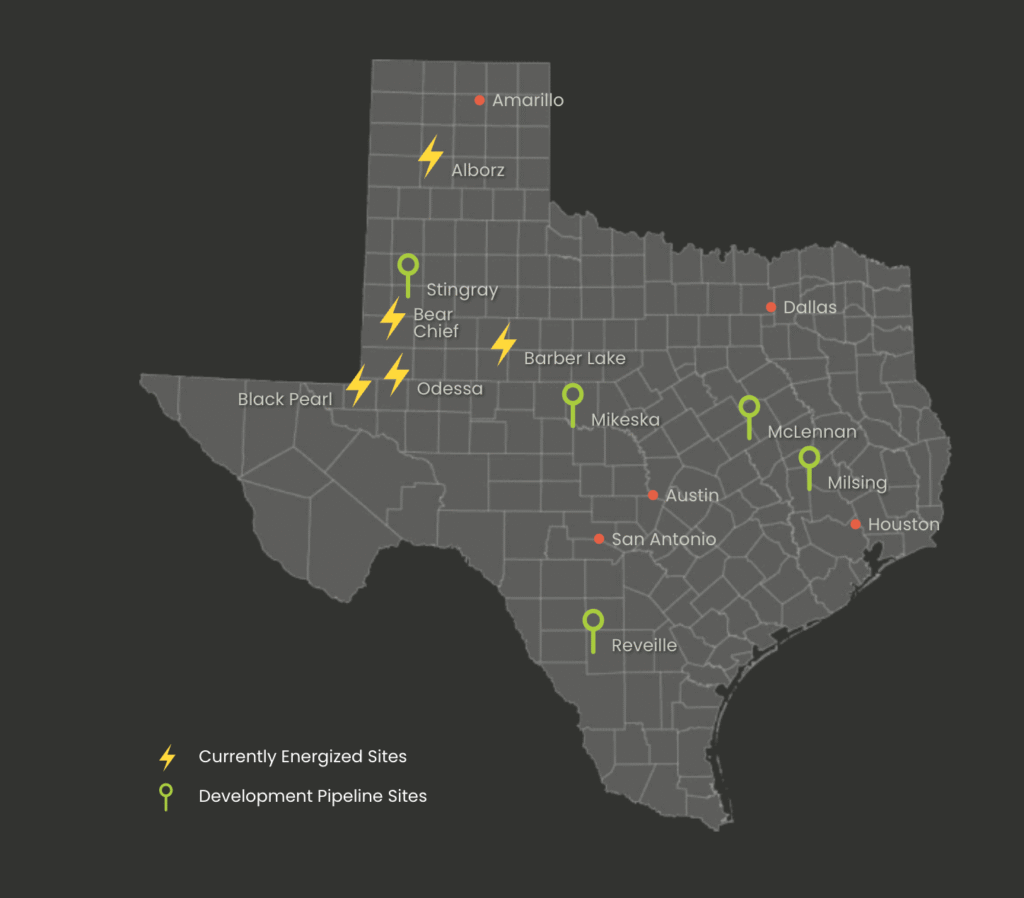

The most important aspect of CIFR’s business is their access to low-cost power (2.7–3 cents per kWh), which is among the lowest in the sector, and its strategic execution in securing and developing energy infrastructure that includes a 3.2 GW power pipeline and over 580 acres of expansion land. This edge they have in power is the foundation for their current BTC mining operations and their pivot into AI/HPC, giving them competitive margins. They have great power, a lot of land, and are never late on buildouts—essentially on-time delivery of sites like Odessa and Black Pearl, etc. This creates what investors and analysts call a “holy trinity” for hyperscaler reliability (Amazon, Google/Fluidstack), which positions CIFR as a leader in the AI infrastructure space and not just the BTC mining space.

The Edge: Why This One, Not Others?

CIFR has many things that set it apart from the competition—things that competitors cannot recreate easily.

Ultra-Low-Cost Power

CIFR’s core edge is in its access to ultra-low-cost electricity (2.7–3 cents per kWh), among the industry’s lowest. They achieve this through long-term fixed-price agreements such as the one with Luminant (a major U.S. power generation company, owned by Vistra Corp.).

Vertical Integration

The next advantage is their ownership of infrastructure over reliance on third parties. Unlike many peers who outsource and lease facilities, CIFR owns and operates its data centers, giving them complete control over buildouts, expansions, and efficiency. This complete vertical integration allows for custom optimizations, including proprietary dynamic curtailment software (automatically and intelligently reducing their electricity consumption in real-time) that enables opportunistic power sales back to the grid (mentioned as a secondary small revenue source). Copying this would require huge upfront capex and construction expertise that competitors do not have.

Hyperscaler Relationships

Furthermore, CIFR has already locked in multi-billion, multi-year deals with hyperscalers for AI/HPC colocation, proving their pivot from mining to HPC/AI. These include: Amazon Web Services (AWS) – $5.5B, 300 MW, 15-year lease Fluidstack (Google-backed) – ~$3.8B, 300 MW, 10-year lease. These deals utilize only 600 MW of CIFR’s 3,200 MW (3.2 GW) pipeline.

Leadership and Operational Discipline

Lastly, the experienced leadership and operational discipline, led by CEO Tyler Page, with backgrounds in hyperscalers, brings institutional expertise in finance, data center operation, and grid management. This also enables disciplined BTC treasury management. CIFR holds approximately 1,500 BTC without forced sales while maintaining a debt-light balance sheet for flexibility during downturns. Competition often over-levers or sells BTC aggressively, eroding their moat. Replicating this human talent is very difficult.

Competitive Threats: How Could a Competitor Kill This Business?

If a well-funded competitor tried to kill this business, they might execute this by aggressively outbidding for power and land resources, which would be the most direct threat to CIFR as a business.

Power stands as the holy grail for both mining and AI/HPC, with demand in grids like Texas’s ERCOT. A competitor could potentially secure superior contracts, using more capital to obtain even lower-cost or renewable energy deals, outbidding CIFR for grid interconnections or expansions. If a rival like IREN (with its faster growth and hyperscale cloud model) scales to 2.9 GW by 2026 while offering 20–30% better net income per MW, it could erode CIFR’s cost advantage.

Other potential attacks:

- Land acquisition: Buy up land near CIFR’s facilities, inflating local energy prices and driving down HPC colocation rates, which would hurt CIFR’s main future form of revenue.

- BTC market manipulation: Potentially dump massive BTC holdings to crash prices, making CIFR’s operations unprofitable—but this would be an unusual scenario.

- Hashrate competition: Ramp up their efficiency, which would increase BTC network difficulty. This could devalue CIFR’s 1,500 BTC treasury, forcing dilution.

- Talent poaching: Offer big packages to key figures like CEO Tyler Page, disrupting execution.

- Regulatory lobbying: Fund lobbying for U.S. mining taxes and energy restrictions—but this would be unrealistic for a competitor to do because it would hurt themselves too.

In conclusion, it would take a combination of unrealistic pressure across multiple fronts to seriously damage Cipher.

Management

Cipher’s management is seen as one of their greatest strengths. Tyler Page has been the CEO since Cipher’s founding in 2021. His background spans over 25 years in institutional finance, fintech, and digital asset infrastructure.

Prior to Cipher, he held senior roles at firms including:

- NYDIG (where he focused on business development and strategic planning for the Bitfury Group)

- Stone Ridge Asset Management

- Guggenheim Partners

- Goldman Sachs

- Lehman Brothers

Under his leadership, Cipher has demonstrated value creation, such as the 15-year, $5.5 billion data center lease deal with AWS and the 10-year deal with Google/Fluidstack.

Valuation and Market Expectations + Claude

As an endeavor of mine to learn how to use Claude and Claude Code more effectively, I used Claude to help me make a comprehensive valuation report for CIFR based on metrics I gave it—such as price per MW, data center multiples, margins for bare metal and colocation outcomes, among other things. To my surprise, it made a very advanced and professional research-level report on CIFR. It really amazes me. (Claude is incredible.) If you want to check it out, I have it ready to download at the bottom of the page. I will include a two paragraph summary if you don’t want to check it out, but I encourage it as it shows what Claude is capable of.

Cipher Mining is executing one of the most compelling corporate transformations in the crypto mining space, pivoting from Bitcoin mining to AI data center infrastructure. The company has secured $8.5 billion in contracted revenue through landmark deals with Amazon Web Services ($5.5B, 15-year lease) and Google-backed Fluidstack ($3.8B, 10-year agreement), with revenue expected to commence in H2 2026. Unlike GPU cloud competitors like IREN and CoreWeave who own their compute hardware, CIFR operates a lower-risk colocation model where tenants bring their own GPUs—resulting in lower revenue per megawatt but also significantly reduced capital requirements and zero technology obsolescence risk.

However, investors should approach the more aggressive price targets circulating online with caution. Some analyses project $200+ per share by 2030, but these often mistakenly apply GPU cloud economics ($8M revenue per MW, 80% EBITDA margins) to what is fundamentally a colocation business ($3-4M per MW, 70-76% margins). Using realistic assumptions grounded in industry benchmarks—and accounting for the 15-20% share dilution likely needed to fund the buildout—a more defensible 2030 target range is $60-80 in a base case, with upside to $120-150 if execution is flawless. At today’s ~$18 share price, that still represents a potential 3-4x return, making CIFR an attractive speculative position for investors comfortable with execution risk—just not the 10x lottery ticket some are advertising.

My take on valuation

In my opinion I felt that Claude was intentionally conservative with its calculations and value forecasts. A potential miss from Claude is that CIFR’s single tenant hyperscaler contracts lead to lower operating complexity, which makes the model much closer to infrastructure leasing than retail data centers. The lower margins mentioned by Claude come from, frankly, worse businesses that don’t have access to ultra cheap power, brand new infrastructure, single tenant lots and predictable loads. This factored in could raise EBITDA margins to 80-85%. Furthermore, CIFR completely avoids GPU depreciation with their colocation model, as tenants are the ones who bring GPU’s. This is a big concern for bitcoin miners and HPC/AI companies, but CIFR does a great job of avoiding it. The risks that it avoids with their none GPU cloud colocation model include: GPU depreciation, GPU refresh cycles, and GPU financing risk. Compared to similar companies such as CoreWeave who buys billions in GPU’s and sees them depreciate over time. On top of this, in AI data centers, power is everything, and CIFR’s whole deal is that they have secured ultra-cheap power, are operating in energy rich Texas, have long term energy contracts, and design for high power efficiency. If you win on power pricing, your margins automatically expand. Lastly, if CIFR executes this shift to AI/HPC flawlessly (which it will), the market will begin to value it as an AI infrastructure platform such as IREN, Coreweave and Nebius, who are all 30-50x earnings. Honestly my price target lies close to $45-55 in 2026, and in 2030 closer to $185+. The name of the game for CIFR is execution, and I believe that with their management they can pull it off.

Above is the Claude assisted research report, determining valuation of CIFR over time. Check it out it’s pretty cool, definitely not perfect, but still good.

My next report will most likely be on IREN, a similar company to CIFR, but later in the stages of the Bitcoin miner to HPC/AI pivot.

Thanks for reading, this is my first research report on a stock, I will keep getting better at researching and writing as I continue.